Rationale

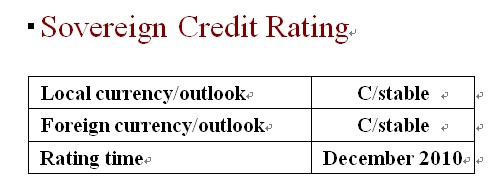

Dagong assigns “C” to the local currency and foreign

currency credit ratings for the Republic of Sudan (hereinafter referred to as “Sudan”)

based on comprehensive consideration of such factors as its volatile political

situation, low level of economic and financial development, highly indebted

government and weak foreign exchange reserves.

The Sudanese government has not released its debt report,

so the public is unable to learn its debt scale accurately. According to the

IMF's estimate, the central government’s debt-to-GDP ratio has already surpassed

80%; moreover, the public debt-to-GDP ratio is as high as 105.1%. Both of the

ratios belong to the highest level in developing countries, which indicates the

heavy debt burden of the Sudanese Government. In fact, most of the government

debt is in arrears. In addition, the government planned a vast investment in the

domestic infrastructure, but limited by its fiscal strength, it has to rely

heavily on financing. However, the government’s financing requirement has been

restrained by the requests from its main creditors such as IMF and World Bank,

who demand the government to control its expenses and reduce non-concessional

loans. It is estimated that in the near future, the frail fiscal status of the

Sudanese government will not be improved effectively; and there will still be

the problems of insufficiency of developing expenditure and arrear of

debt.

On the whole, the Sudanese government has a weak capacity

for foreign and local currency debt repayment. The main reasons are as

follows:

l

North-South issue and the Darfur issue are unlikely to be completely resolved in the

near future, so the future tense situation will continue. The political

situation in Sudan will remain a long term

constraint to the development of economy and the government credit;

l

Sudan has a weak

economic basis and single economic structure and belongs to the most undeveloped

countries. Due to the impact of severe domestic and international political

situation, its abundant agricultural and oil resources have not been effectively

transformed into the driving force to promote economic

development;

l

Sudan’s financial

sector is small and undeveloped; its banking system is weak. High rate of

non-performing loans increases the government’s contingent liabilities, which

limits the government’s credit;

l

Sudan relies heavily on oil export revenues for its

fiscal revenue, and consequently, the stability of fiscal revenue is subject to

the fluctuation of international oil price to a great extent; its narrow tax

base and lower tax revenue limit the government’s ability to use tax policy to

regulate the economy;

l

Sudan’s foreign

exchange revenue relies heavily on oil exports as well as foreign direct

investment, so the international balance of payment is rather fragile, which

yields very weak foreign exchange reserves. While the external debt burden is

extremely heavy, there is an urgent need for debt relief from its main

creditors.

Outlook Both

the conflict between the central government and Southern government and the

conflict between the central government and Darfur armed groups cannot be fully

reconciled in a short term, but none of the single party can dominate the

domestic political situation just by itself with its current strength, which

determines that the political situation in Sudan will

continue to maintain the existing situation, and still be the key factor to

constrain the economic development, improvement of fiscal status and debt

service. Affected by this, the process of improving the environment of economic

development in Sudan and debt relief sought by the

government will be very slow. And the fragile balance of international payment

will continue. Therefore, Dagong keeps the stable outlook for

Sudan’s sovereign credit rating of

both the local currency and foreign currency in the next 1-2 years.

|