Rationale

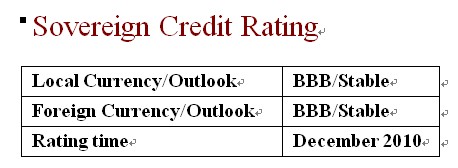

Dagong assigns “BBB” to both the local and foreign

currency long term sovereign credit ratings of the Republic of Ireland

(hereinafter referred to as “Ireland”) based on a comprehensive analysis of the

government’s soaring debt burden and all the elements to impact the debt

repayment risk as national management capacity and economic, fiscal and

financial strength.

After the financial crisis happened in 2008, the Irish

government’s debt burden increased quickly. In the over ten years before the

outbreak of the financial crisis, the Irish government’s debt burden was in a

significant downward trend due to the long-term economic prosperity. By the end

of 2007, the general government’s debt only reached 25.0% of GDP. However, in

order to rescue the banking system and make up a structural deficit, the

government’s debt ratio soared to 65.6% of GDP by the end of 2009. Despite the

continuing fiscal tightening, the government’s funding requirement will rise to

51.6 billion Euros and the general government’s debt-to-GDP ratio will increase

to 96.9% in 2010. Owing to the declining temporary deficit in 2011, the total

funding requirement is going to decrease to 30.3 billion Euros and the general

government’s debt will account to 105% of GDP.

The Irish economy and financial system were hit hard by

the financial crisis under a high degree of risk exposure and the government’s

solvency was severely impacted with an unsustainable fiscal situation. However,

Ireland has also a distinct advantage

to support for its gradual recovery. In general, the main reasons to assign the

current sovereign credit rating results are:

l

The

Irish long-term preferential policies to attract international capital and

develop education and research system help to foster the developed high-tech

manufacturing, which is the main advantage for the future economic development.

However, the abnormal prosperity of real estate industry caused the economic

imbalance and the economic structure adjustment is necessary, thus the economic

recovery will be slow. It is estimated that the GDP growth rate in 2010 and 2011

will be -0.2% and 0.5% respectively.

l

The

burst of bubbles in real estate industry was followed by the collapse of banking

system, which still faces a serious risk of bad debts and liquidity risk, thus

the credit to the real economy continued to contract. The government direct

capital injection and the upcoming assistance from IMF and EU will help to

improve the banking system resistance, but the heavily dependence on the

European Central Bank financing and official relief cannot be changed in the

short-term.

l

The

government’s structural fiscal deficit in the economic downturn combined with

the temporary deficit caused by the relief to the banking sector deteriorated

the fiscal situation. Due to the increasing bond yield in the bond market panic,

the Irish government has to reply on the relief mechanism as the main funding

source. The future fiscal adjustment pressure in the medium term is quite high.

l

As a

member in the EU and Euro Zone, the Irish massive external debt are out of

exchange risks and the government has advantage to access to the market

financing and get assistance from financial stability mechanism of the EU.

Outlook

As

the economic structural adjustment needs time, the deleveraging process of the

government and family will continue to compress their domestic demand, and the

exports have limited role in driving economic growth. Due to the lack of

economic growth source, the Irish economy will experience a slow recovery and

the banking system will continue to fight with its deteriorating assets.

However, the relief from EU and IMF helps to quell the Irish sovereign debt

crisis. Their adjustment procedure for the Ireland will

help to restructure the banking system and restore the fiscal balance.

Therefore, the government’s debt repayment risk is relatively stable. Generally,

Dagong keeps the stable outlook for Irish government’s local and foreign

currency credit rating in the next 1-2 years.

|